穆迪下调德国默克评级至Baa1 持消极展望

2014年12月12日,穆迪投资者服务宣布下调德国默克发行长期和高级无担保债公司的评级由A3至Baa1。同时,穆迪还正在审查默克发行15亿欧元初次级债的最终文件,但默克短期债评级保持不变。所有评级的展望都是消极的,今天的评级下调是对2014年9月23日初次评级的修正。

穆迪副总裁兼默克首席分析师Stanislas Duquesnoy认为,完成对Sigma的并购将导致默克的债务增长三倍,债务急剧增长导致公司信用评级只能与Baa1相匹配,但是这应该只是一个过渡情况,预计集团能够产生足够的自由现金流使公司迅速去除高负债杠杆。

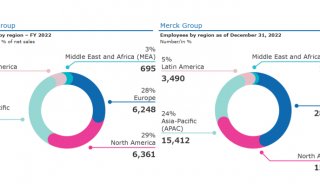

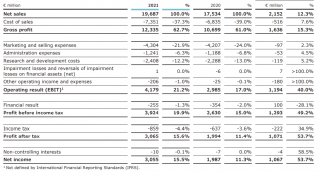

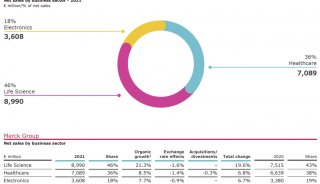

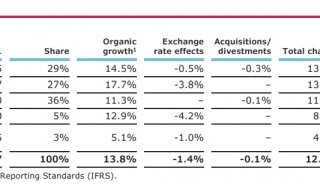

默克公司宣布以140美元/每股全现金要约收购了Sigma-Aldrich公司后产生该评级。若该交易完成默克公司预计调整债务自2014年9月将从约56亿欧元增加到170亿欧元(包括50%次级债券股权信用)。这样将导致EBITDA负债率从1.8倍增加到4.5倍,营运现金流与负债的比例也将从40%左右下降到20%以下。这些所有指标都标志着默克公司的评级在Baa1外。

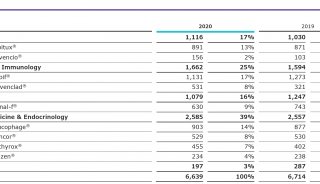

不过穆迪的决定也考虑了收购Sigma背后的强大战略基础,这将扩大默克密理博的客户和产品,加强其市场准入,整合后公司在生命科学行业中排行第二。此外,Sigma是一家具备良好管理、高利润和自由现金流的生命科学公司。因此穆迪估计合并后的默克集团每年将产生约20亿欧元自由现金流。这笔款项将支持去除高负债杠杆,评级机构预期当前集团疲软的信用状况是一个过渡期,虽然处于一段较长周期。

根据穆迪当前预期和默克给予的未来几年主要的债务融资机构和用于去杠杆化的未来现金流的承诺,默克公司的信用指标预计将在Baa1评级的24个月内回归到与之相称的目标水平。

该评级还考虑到默克与辉瑞公司的合作计划,共同开发和推广默克抗PD-L1。为此默克公司将受益于8.5亿美元的预付款和更低研发费用和风险分担。此外,提出的50%混合发行的股权信贷相对于收购Sigma提出充分债务融资将会对默克公司的信用指标有一定程度上的积极影响。默克公司强调承诺迅速取出债务杠杆,并保持较高的投资评级。

Moody's downgrades Merck KGaA's ratings to Baa1; negative outlook

Frankfurt am Main, December 12, 2014 --Moody's Investors Service has today downgraded the long-term issuer and senior unsecured ratings of Merck KGaA (Merck) and its rated subsidiaries to Baa1 from A3. Concurrently, Moody's has assigned a definitive Baa3 rating to the EUR1.5 billion worth of junior subordinated notes issued by Merck following its review of the final documentation. Merck's and its rated subsidiary's P-2 short-term issuer and (P)P-2 ratings remain unchanged. The outlook on all ratings is negative. Today's rating action concludes the review initiated by Moody's on 23 September 2014.

"We are downgrading Merck's ratings as its adjusted debt will more than triple upon completion of its proposed acquisition of Sigma," says Stanislas Duquesnoy, a Moody's Vice President and lead analyst for Merck. "While such a dramatic build up of debt would lead to deterioration in the company's credit metrics beyond that commensurate with a Baa1 rating, we see this as being only a transitional situation as the combined group would generate significant free cash flow that would allow the company to quickly delever."

RATINGS RATIONALE

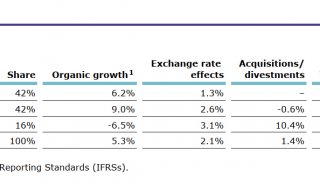

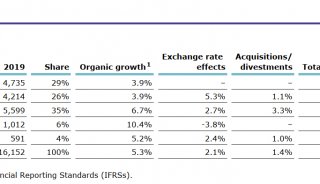

The rating action follows Merck's announcement that it has made an all-cash offer to acquire the shares of Sigma-Aldrich Corporation (Sigma) for $140 per share. If the transaction completes as proposed, Merck's pro forma adjusted debt for September 2014 will increase from approximately EUR5.6 billion to around EUR17.0 billion (including the 50% equity credit for the subordinated notes). As a result, the pro forma credit metrics of Merck will deteriorate markedly with debt/EBITDA increasing to around 4.5x from 1.8x and cash flow from operations /debt declining to below 20% from around 40% currently. All of these metrics position Merck outside the Baa1 rating category.

However, Moody's decision also considers the strong strategic rationale behind the Sigma acquisition. It will broaden Merck Millipore's customer and product basis and will increase its market access with the combined entity becoming number two in the consolidating life science industry. In addition, Sigma is a very well managed, highly profitable (i.e., EBITDA margin in excess of 30% and return on invested capital (ROIC) of around 20%) and free cash flow generative (i.e., free cash flow/EBITDA of around 50%) life science company. Moody's therefore estimates that Merck, as a combined group, will generate significant free cash flows of around EUR2.0 billion per year. This amount will support deleveraging prospects and the rating agency's expectation that the current weakness in the group's credit profile is transitional, albeit for an extended time period. Based on Moody's current expectations and given Merck's commitment to refrain from major debt-financed acquisitions in the next couple of years and to use future cash flows generated to delever, Merck's credit metrics are expected to be back to target levels commensurate with a Baa1 rating within 24 months after closing.

The rating action also takes into account the planned cooperation of Merck with Pfizer Inc. to jointly develop and commercialize Merck's anti-PD-L1. Merck will benefit from an upfront payment of $850 million and lower R&D expenses as well as risk sharing for this interesting pipeline asset. In addition, the proposed hybrid issuance with a 50% equity credit will have a modest positive effect on Merck's credit metrics compared to the initially proposed full debt financing of the Sigma acquisition. It also underlines Merck's commitment to delever quickly and to maintain a high investment grade rating.

Moody's has concluded its review for downgrade following the vote on 5 December of a majority of Sigma's shareholders in favour of the transaction and the issuance of EUR1.5 billion of subordinated notes. The agency expects no material anti-trust issues, which could put the closing of the transaction at risk, hence the rating agency's decision to conclude the review process.

-

企业风采

-

企业风采

-

焦点事件

-

企业风采

-

会议会展

-

企业风采

-

焦点事件

-

精英视角

-

企业风采

-

人物动向

-

招标采购