Invitrogen究竟会不会保留质谱业务?

在Invitrogen宣布将以67亿美元收购ABI公司之后,人们的议论就一直没有停止。现在大家又开始津津乐道地讨论Invitrogen保留ABI质谱业务的理由,以及它是否会很快抛弃这部分业务。

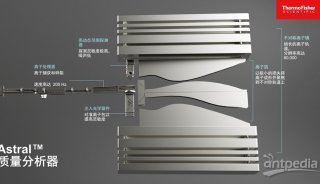

尽管ABI是质谱业务的行业领先者,但是近年来这部分业务正急速下滑,而它的竞争者:赛默飞世尔科技和Waters在质谱技术创新上占据了主要地位,安捷伦也抢走了其部分市场份额。人们开始担心ABI是否能扭转这种局面。

在上星期的电话会议中,Invitrogen CEO Greg Lucier对于新公司质谱业务的态度也有点含糊。当被问到如果有机会,他是否会卖掉这部分业务时,他谢绝对这种可能性做出评价,并表示“会继续运营这部分业务”。

Lucier表示收购中有90%是“完美的契合”,但质谱不是。他表示,理想的状况是客户在购买了一台仪器之后,会持续购买大量的试剂。但是,“质谱仪不大符合这种理想状况,所以我只说90%是完美的契合,而另外10%也是很好的业务,我们打算继续运行。”

但是这些话并没有减轻华尔街的担心,他们担心ABI衰退的质谱业务会损害这场交易。评论家Peter McDonald认为,近年来ABI没有推出任何新的有意义的质谱平台,这很让投资者担心。“每个人都在等待一台新仪器的出现,但是却始终没有。”

ABI也意识到了这一点,它计划补充仪器产品线,在下个月推出新的质谱仪。在上周的电话会议上,ABI公司的董事长兼COO Mark Stevenson也表示这些计划将继续进行。

近年来质谱销售量的停滞不前对ABI来说也是坏消息。在过去连续6个季度中,仪器的销售增长在持续下降,在上一季度,即1~3月,质谱的销售额增长不到1%。

德意志银行分析家Ross Muken在一篇研究评论中写到,Invitrogen对ABI感兴趣的最主要原因是能够获得它的SOLiD测序平台,从而进入新一代测序市场。Invitrogen想要维持质谱业务是一个大难题。他表示:“如果你把质谱业务摆在新公司中,你就会很清楚发现它不适合。而且它与新公司的其他业务没有互补的地方。”

Muken补充说,Invitrogen在改善ABI质谱业务上也能力有限。因为ABI是与MDS合资经营的,质谱的研发主要是依靠MDS这家加拿大公司。

实际上,收购提议对于ABI与MDS的伙伴关系有什么样的影响现在还不清楚。Invitrogen及ABI的官员在电话会议上都没有对这件事做出评论。

MDS的发言人Janet Ko表示公司会照常开展业务。MDS评价这个事件是“我们合资伙伴的好消息,并相信Invitrogen有杰出的管理团队,期望与它们共同发展ABI/MDS的合资。”

同时,人们开始推测新公司将最终卖掉质谱业务,最快在1年半之内。Muken表示估价在13亿~15亿美元质检,但可能的买家非常有限。他说:“这是一个非常有吸引力的资源,但并不是很多人能够买得起,或有这个能力来处理它。”

分析家表示,普遍认为如果合并后的公司决定放弃质谱业务,MDS似乎是最有可能的投标者,尽管MDS现在还不具备这样的资源来进行这笔大买卖。其它的潜在买家可能包括安捷伦、赛默飞世尔或外国公司如日立或岛津。

参考英文原文

Invitrogen Deal to Acquire ABI Leads to Mass Speculation About Mass Spec Business

[June 20, 2008] By Tony Fong Editor, ProteoMonitor

NEW YORK (GenomeWeb News) - As the dust settles from last week’s announcement of Invitrogen’s bid to acquire Applied Biosystems for $6.7 billion, questions continue to swirl around Invitrogen’s rationale for keeping ABI’s mass spectrometry business, and whether the company has plans to quickly jettison the segment.

While ABI is the current industry leader in mass spec sales, it is in the midst of a sharp slowdown that has raised concern about ABI’s ability to turn the unit around, particularly as competitors such as Thermo Fisher Scientific and Waters move to take the lead in technological innovation and Agilent Technologies takes market share away with its continuing push into the space.

During last week’s conference call announcing the proposed deal, Invitrogen CEO Greg Lucier was opaque when discussing plans for the new company’s mass-spec business. When asked whether he was open to selling it if the opportunity was there, he declined to comment on that possibility and said, “We’re going to run that business. We’re going to run it for success with our partner, and it is business as usual.”

Lucier said that while 90 percent of the acquisition is “an absolutely perfect fit,” mass specs are not. The ideal situation, he said, would be a sales flow in which customers would need to buy large amounts of reagents for use on the newly acquired instruments. Only, “a mass spec instrument doesn’t quite fit that description,“ Lucier said. “So my comment was 90 percent of [the deal] is a perfect fit, and the 10 percent [remaining] is still a very good business, and we intend to run it,” he said.

That has done little to quell Wall Street’s worries that ABI’s flagging mass-spec business could hurt the deal. Peter McDonald, an analyst at Wall Street Access, told GenomeWeb Daily News sister publication ProteoMonitor this week that the lack of any new meaningful mass spec platform from ABI in recent years is a particular concern for investors.

“Everyone’s been waiting for a new instrument and they haven’t had anything in the near term,” he said.

Aware of this, ABI plans to replenish its instrument portfolio and recently company officials said new mass specs will be hitting the market in coming months. During last week’s conference call, Mark Stevenson, president and COO of Applied Biosystems, said that those plans will proceed.

Plateauing mass-spec sales in recent quarters have also been bad news for ABI. For the past six consecutive quarters, sales growth for the instruments has steadily declined, and in the last completed quarter, ending March 31 – ABI’s fiscal third quarter – mass spec sales grew less than 1 percent.

Ross Muken, an analyst with Deutsche Bank, wrote in a research note that the key reason for Invitrogen’s interest in ABI is to acquire its SOLiD sequencing platform and gain access to the next-generation sequencing market.

Invitrogen’s desire to keep the mass-spec business, however, is “a head-scratcher,” Muken wrote.

“As you look at mass spec within the new [company] it’s a clear standout that does not fit,” Muken said to ProteoMonitor. “And it really has no complementary pieces with the rest of the Invitrogen/ABI combination.”

Invitrogen is also limited in its ability to improve ABI’s mass-spec business, Muken added, because ABI has a joint-venture agreement with MDS Analytical Technologies on the instruments and depends on the Canadian firm for mass spec R&D.

Indeed, the effect of the proposed acquisition on ABI’s partnership with MDS is unclear. Neither Invitrogen nor ABI officials provided any insight into the matter during the conference call.

Janet Ko, a spokeswoman for MDS, told ProteoMonitor in an e-mail that it will continue to do business as usual. MDS views the deal “as good news for our [joint-venture] partner [and] believes Invitrogen has an excellent management team, and we look forward to working with them to grow the ABI/MDS joint venture,” she said.

Meanwhile, speculation has begun that the new company, which will adopt the Applied Biosystems name, will eventually sell the mass spec business, perhaps as quickly as within 18 months. But with an estimated price tag of between $1.3 billion to $1.5 billion, the list of potential buyers is limited, Muken said.

“It’s an attractive asset but there’s not a long list of people who can afford it or would be in a position at this point to be able to do something to transact it,” he said.

The consensus view is that MDS appears to be the most likely bidder to buy out ABI if the combined company decides to divest its mass-spec business, although MDS currently doesn’t have the resources to make such a purchase, analysts have said. Other potential buyers could include Agilent, Thermo Fisher, or foreign firms, such as Hitachi or Shimadzu.