默克欲以超70亿美元收购Cubist

默克公司上周五传出一则即将完成的交易,欲用超过70亿美元收购Cubist Pharmaceuticals。预计该交易将在本周内正式公布,这宗交易也是默克通过收购中型制药公司来扩展业务战略的一部分。

按照收购对价100美元/股计算,Cubist公司价值近75亿美元,相比周五收盘时价格溢价超过34%。位于马萨诸塞州的Cubist主要生产抗生素类药物,其旗舰产品Cubicin(克必信)在2013年销售额达9.67亿美元。尽管抗生素药物利润普遍不被看好,但分析人士预计,新型抗生素仍然可以为公司赚取高额利润。

根据公司公布,Cusbist第三季度销售额达3.09亿美元,较去年同期增长16%。去年,Cubist也收购了一些小型公司,如Trius和Optimer,进一步巩固了其在抗生素市场的地位。

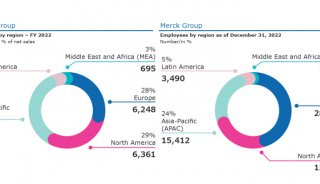

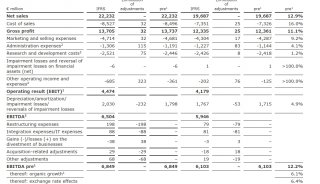

默克是继辉瑞后的美国第二大制药商,拥有超过1740亿美元的公司市值,据报道,默克公司2014年三季度销售额达105.6亿美元。今年6月,公司以38.5亿美元的价格收购了主要生产抗病毒类药物的Idenix Pharmaceuticals,10月,又将其消费类业务以142亿美元的价格出售给了拜耳(Bayer)。

Merck Tries To Acquire Cubist Pharmaceuticals For More Than $7B

Merck & Co. is near closing a deal to buy Cubist Pharmaceuticals Inc (NASDAQ:CBST), an antibiotics-maker, in a deal worth more than $7 billion, reports said Friday citing company officials. The deal, which is expected to be announced next week, comes as a part of Merck’s strategy to buy mid-size drug makers to expand its business.

New Jersey-based Merck would pay nearly $100 per share for Cubist, valuing the company at nearly $7.5 billion, about 34 percent more than Cubist’s closing price on Friday,

The Wall Street Journal reported. Massachusetts-based Cubist makes drugs that fight infectious diseases and manufactures its flagship drug Cubicin, which recorded sales of $967 million in 2013. Although antibiotics are not considered to be a lucrative option for the drug industry, analysts expect that new versions could earn high profits for the companies.

The deal would also allow Merck to access Cubist’s medicines, which are mostly used in hospitals,according to CNBC.

Cusbist’s focus area for its products is on manufacturing drugs that could address “significant unmet medical needs,”

including diseases that lead to global pandemics, according to the New York Times. The company reported sales of $309 million in the third quarter of this year, showing an increase of 16 percent over the last year for the same quarter. Last year, Cubist had also acquired smaller businesses like Trius and Optimer, further expanding its foothold on antibiotics segment, CNBC reported.

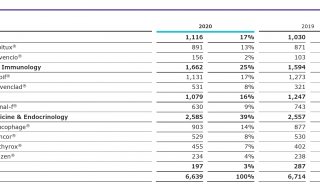

Merck, which is the second largest American drugmaker after Pfizer (NYSE:PFE), has a market value of over $174 billion and reported sales worth $10.56 billion in the third quarter of 2014, the Times reported. While the company’s vaccine for cervical cancer faces increased competition, its diabetes drug, the largest line for the company, continues to clock high sales.

In October, Merck also closed a deal to sell its consumer business to Bayer for $14.2 billion. In June, Merck bought Idenix Pharmaceuticals, which makes drugs for treating human viral diseases, for $3.85 billion.