ABI推出新型质谱,欲图扭转质谱业务再上顶峰

2008年10月16日

经过几个月的猜测和预期,美国ABI公司和它的质谱合资伙伴MDS于上周推出了两款新型质谱系统,从而结束了ABI公司在历经18个月技术创新乏力而导致的质谱业绩下滑局面。

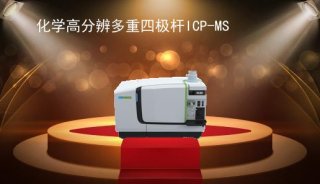

这两台新型仪器分别是5500型三重四级杆质谱仪和5500型Qtrap线性离子阱质谱仪,根据AB和MDS的说法,这两台仪器代表了最先进的质谱技术。

新品的发布同时标志了ABI公司超过三年来最重大的质谱发布事件。在新产品的市场驱动下,新产品的发布对在质谱产业上已经呈下滑趋势的ABI公司来说,起到了强有力的推动作用。

在网上宣布推出后,ABI公司和MDS官方声明,建立在完全重新设计的平台上的新型质谱仪将成为“下一代”的系统。

MDS的分析技术总裁Andy Boorn指出,要创新而不是在原有的仪器上进行改动,5500型三重四级杆质谱仪和5500型Qtrap线性离子阱质谱仪可以被称为是真正的创新。

虽然两家公司还缺乏具体的数据来支持他们的声明,ABI公司蛋白质和小分子部门经理Laura Lauman指出:“下一代的质谱系统在为我们的客户提供创新性的解决方案方面,树立了ABI和MDS公司合作的一个重要里程碑。伴随新仪器的推出,我们再次为质谱的性能建立了新的标准。”

5500型三重四极杆质谱仪

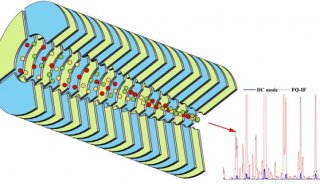

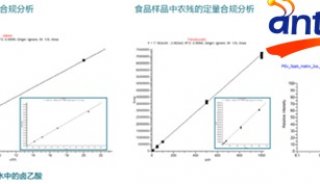

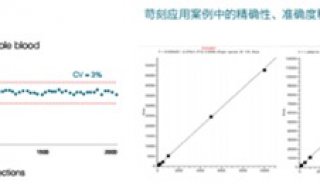

在5500型三重四极杆质谱仪中,采用了新型的脉冲计数探测器AcQuRate,它能够“有效地”检测离子来增加定量的准确度和精密度。根据ABI/MDS的说法,5500比其它质谱仪的灵敏度至少高5倍。

Boorn虽然没有提供细节,但他指出弯曲180度的线性加速碰撞池(Qurved LINAC Collision Cell)和eQ 电子学技术,提高了分析速度和扫描速度。

他补充说道:“该仪器可以在复杂样品的低浓度下检测出更多的目标物质,可以从一次简单的实验中获得大量的数据,并具有更高的定量准确性和更低的检测限。”他们没有提供具体的数字。

5500型Qtrap质谱仪

同时,5500型Qtrap线性离子阱质谱仪也具有5500型三重四极杆质谱仪的特点,并结合了一款新的线性加速的离子阱(Linear Accelerator Trap)技术,“该技术是为建立一种在线性离子阱模式下定性的新标准而专门设计的。”公司的发言人在一份声明中说。

这台仪器中的另一项新型的技术是三重阱扫描(Triple Trap Scanning),Boorn说到:“该技术可以使科学家们,从灵敏、确定性非常高的三重四极扫描模式,在不到1毫秒的时间里切换到高灵敏的全扫描离子阱模式”,这是在其他仪器上无法实现的数据驱动(data-driven)的采集流程。

在蛋白质组学研究中,QTrap 5500 使研究者们定量和确认“大量的蛋白质和肽段,并具有比其它任何已有系统更高的灵敏度、重现性、精密度。”Lauman指出,虽然也没有给出具体数字。

ABI公司的蛋白组和小分子学新技术业务部的经理Dominic Gostick指出,蛋白质组研究人员目前关注的生物标志物发现需要更多的靶向方法,而Qtrap 5500可以赋予研究者更强的能力去发现相关的生物标志物。

“人们现在已经发现了相当数量的潜在的生物标志物,但是现在对他们来说未必有用。”他说,“我认为在小分子和蛋白质组的研究中,该技术都会提供新的能力,因为该仪器可以对这些推测的生物标志物进行核查和验证。”

“而且对人们来说确实是非常迫切的需要,他们需要导向目标追踪,把真正临床相关的生物标志物和只是实验的人工品区分开来。”

--------------------------------------------------------------------------------

贯彻其一致性是绝对必须的,换种说法就是保持它的市场领先地位。

--------------------------------------------------------------------------------

在多伦多Mt. Sinai医院Samuel Lunenfeld研究所的研究人员,使用了早期阶段的仪器。对他们而言,具有更高MRM灵敏度和更快速度的QTrap 5500是非常有诱惑力的。

该研究所的质谱专家Lorne Taylor说到:“在样品相当复杂的情况下,我们经常发现MRM自己使研究人员进入误区,常得到一些假阳性的信息”,“QTrap 5500可在第一毫秒进行MRM的测量,接下来在第二毫秒进行MS/MS的工作,我们拥有惊人的速度,我们可以确认我们测量的结果是真实的。”

此外,每个时间单元具有更快的分析速度可以使研究人员在实验中嵌入更多的控制。

“我们把这些在复杂基体中的蛋白质用胰蛋白酶酶解,我们通过测量它们的碎片(肽段),然后从中推断生物学性质”,Taylor说到,“从多肽回到蛋白质,有大量活动的部分/步骤,所以在这里嵌入控制是至关重要的,使用这台新型仪器,可以更灵敏地获取更多信息,使我们不仅能够寻找到以前找不到的物质,并且还能控制他们。”

这种新型的平台非常符合ABI公司的试剂和工作流程技术,其中包括用于目标物定量的蛋白质组学软件MRMPiolot和MultiQuant,和mTRAQ试剂。

这套新系统定价为$450,000 ~ $490,000。Lauman说,ABI公司已经有了客户订单并且该仪器已经在运输过程中。

贯彻其一致性

两款新仪器珊珊来迟,比ABI公司质谱业务的估计晚了几个月,ABI官方承诺该仪器会在年底打入市场。尽管ABI公司仍被认为是业界的领先者,但是至少在人们的感觉中,MDS分支已经作为技术的革新者开始沾沾自喜了。

ABI公司最后推出的一款重要的质谱仪器是测量小分子的API 5000,于2005年1月推出,接下来四个月后推出了型号为4800的MALDI TOF/TOF仪器,用于研究蛋白质生物标志物。

此后ABI公司推出的新型系统都只是在原有平台上进行改善,并没有革命性的创新。

与此同时,竞争对手例如Thermo Fisher 和Waters公司利用ABI公司的技术停滞,分别推出了Orbitrap和Synapt两款新型的仪器,被他们推广为变革性的技术。同时,Agilent科技,一度在质谱界被看作是边缘玩家的安捷伦科技,也扩大了其在市场上的占有位置。

来自Wall Street Access研究投资公司的分析师Peter McDonald指出,上周的新品发布是ABI公司击退其他竞争对手的重要一步。“贯彻其一致性是绝对必须的,也就是说,保持他们在市场上的领导地位”,他说道:“我不认为新品的发布是一个戏剧性的重塑事件,但它确实搅起了涟漪,可能迫使购买者为了这个新型的系统而推迟购买时间。”

他还指出:“总体来说,这是件好事,可以继续推动和扩张整个市场潜力。”

Lauman认为5500三重四极 和 QTrap 5500的研发周期比ABI公司自己预想的要长,因为融入到仪器设计中的创新,“使我们能够非常迅速地建立起衍生平台。”

Boorn指出这两台仪器的推出仅仅代表了MDS在这25年里在LC-MS领域里的第三次改革,并在这个领域里创建了一个新的平台。

“我们的研究人员和工程师队伍对仪器上的每一个部件都进行了检查,基本上全部更换了它们,然后在和我们全球客户非常紧凑的调查反馈循环中,不断询问他们是否真正的解决了他们的问题。”

许多来自客户的问题和要求是“非常难以解决的”,他补充说,包括对更小尺寸仪器的需求。这台新型的系统比以往的系统尺寸要小44%。

Boorn指出,加快该系统的检测速度是一项非常“具有挑战性的研发任务,需要完全重新设计电子学部分,发明新型扫描模式,设计离子光学,才能确实、确实、确实得达到快速扫描的要求。”

对于ABI公司来说,该技术的推出恰好是在该公司的质谱业务处在一个非常极有挑战性的时期。尽管没有给出具体的数据,但是ABI的竞争对手们已经在前几个季度的质谱销售领域里茁壮成长。ABI公司的质谱销售业绩比去年同期相比已经成下降趋势。在连续的六个季度中,质谱的销售业绩连年下滑,已经从14%(截止到2006年12月31日的三个月)到不到1%(截止到2008年3月31日的季度)

对于截止到6月30日的这三个月里,最近的一个季度销售业绩显示比同期相比上升了4%。该公司将在10月22日宣布2009第二季度的销售业绩。

ABI公司的前母公司Applera公司(不久前被分为ABI和Celera两个独立的公司)的前首席执行官Tony White,和ABI公司的总裁兼首席运营官Mark Stevenson同样认为,延迟新型仪器的推出,已经削弱了该公司的销售业绩。

当在夏季ABI公司和Invitrogen公司宣布以67亿美元兼并时,立即引起ABI公司可能出售质谱业务的猜测,因为它没有纳入合并后的公司的商业模式。虽然ABI和Invitrogen公司的官员坚持说他们的每一个意图都是为了保持质谱业务,但是MDS公司的首席执行官Stephen DeFalco在近期的一个分析会议上含糊地提出了一个观点,MDS公司正与ABI公司协商合资协议,不排除从他的合作伙伴那里收购质谱业务。

然而,ABI和Invitrogen公司最近声明,质谱部门将成为合并后公司四大分支中的一个。上周Stevenson称这次发布为:“展现了质谱市场一个令人兴奋的时期”,该仪器将会继续被应用于更多的应用领域,发布新品“表明了我们将会继续致力于这一重要市场”。

华尔街分析师McDonald指出,随着ABI / Invitrogen公司预计在11月完成合并,新型质谱仪的发布和下一代测序平台SOLiD 3.0 的发布,说明了ABI公司依旧保持着在技术研发领域的进取心。

他还说到:“我认为这是一个好的迹象,那就是合并本身并没有削弱他们开发新产品的势头,这是一个好信号,一旦交易完成,每个业务都会被整合得相当好。”

参考英文原文:

ABI Launches New Mass Specs as It Tries To Turn MS Biz Around and Stay On Top

[October 16, 2008]

By Tony Fong

After months of hints and wide anticipation, Applied Biosystems and its MS joint-venture partner MDS last week launched two mass spectrometry systems, putting an end to a technology drought that dragged down ABI’s mass spec business for the past 18 months.

The two new tools, the AB Sciex Triple Quad 5500 and the AB Sciex QTrap 5500, represent the most advanced mass specs ever, according to the partners.

The announcement also happens to mark the firms’ most significant mass-spec introduction in more than three years. In a segment driven by new products, the launches may provide the spark needed to revive ABI’s mass spec business, which has been on the decline recently.

In a webcast announcing the introductions, ABI and MDS officials said that the tools are “next-generation” systems built on new platforms that were designed from the ground up.

To wit, rather than replacing pre-existing instruments, the Triple Quad 5500 and QTrap 5500 are “a true expansion” of the companies’ portfolio, said Andy Boorn, president of MDS Analytical Technologies, the division within MDS that develops and manufactures mass specs.

The companies were short on specific data backing up their claims but according to Laura Lauman, president of ABI’s proteomics and small-molecules division, “These next-generation mass-spec systems represent a significant milestone for the joint venture and Applied Biosystems in providing innovative solutions for our customers. … With this launch we are once again setting new standards for performance in mass spectrometry.”

In the Triple Quad 5500 instrument a new pulse-counting detector, AcQuRate, “effectively” detects ions to increase quantitative accuracy and precision. Compared to other triple quads, the 5500 is up to five times more sensitive, according to ABI/MDS.

New components such as the Qurved LINAC Collision Cell and eQ Electronics increase analysis speed and scanning speeds, according to Boorn, though he did not provide details.

The instrument, he added, enables researchers to ID “the greatest number of target analytes at the lowest concentrations in complex samples … [and] enables a great amount of data to be acquired from a single experiment [resulting in] greater quantitative accuracy and lower limits of detection.”

No specific figures were provided.

Meanwhile, the QTrap 5500 takes the features of the Triple Quad 5500 and combines them with a new Linear Accelerator Trap technology, which is “designed to set a new standard in the linear ion trap-based qualitative mode,” the companies said in a statement.

Another new technology built into the machine, Triple Trap Scanning, allows scientists to migrate from “sensitive, very specific triple quadrupole scan model to highly sensitive full scan ion trap mode in less than 1 millisecond,” Boorn said, enabling workflow data-driven acquisition that cannot be achieved on other systems.

For proteomics research, the QTrap 5500 allows researchers to quantify and confirm an “increasing number of proteins and peptides with greater sensitivity, reproducibility, and precision than any other available system,” said Lauman, though no specific figures were given.

Dominic Gostick, director of new technology business for proteomics and small molecules at ABI, said that as proteomics takes on an increasingly targeted approach to biomarker discovery, the new instruments will give researchers greater capability to find relevant biomarkers.

“People have now discovered fairly long lists of potential biomarkers, and that’s not actually proving to be that useful for them today,” he said. “And I think this technology in both small molecules and proteomics offers a whole new capability because they can take these lists of putative biomarkers and shift those into verification [and] validation.

“And that really is compelling to people because they need to home in on what are the clinically relevant biomarkers against what has just been an artifact of the experimentation,” he said.

--------------------------------------------------------------------------------

“It’s definitely necessary to keep them in line with the herd, so to speak, and maintain their market leadership position.”

--------------------------------------------------------------------------------

Researchers at the Samuel Lunenfeld Research Institute of Mt. Sinai Hospital in Toronto were allowed access to an early iteration of the instruments. For them the higher MRM sensitivity and faster speed of the QTrap 5500 is especially appealing.

“Even with … moderately complex samples, we have noticed routinely [that] MRM by itself can lead you astray. It can give a lot of false positive information,” said Lorne Taylor, mass spectrometry specialist at the institute. With the QTrap 5500, “we can do an MRM measurement in 1 millisecond in this new box, then we can flip and do an MS/MS in 2 milliseconds, so we have incredible speed. … We want to be very, very sure that we’re measuring what we think we’re measuring.”

In addition, the faster speeds allow for more assays per time unit which in turn will allow researchers to embed controls into the experiments.

“We take these proteins in complexes and we rip them apart to pieces with trypsin. We measure the pieces and then we infer biology back from that,” Taylor said. “There [are] a lot of [moving parts] going from peptide back to protein. Embedded controls are crucial here, so with the ability of the new machine to do so much more at a higher sensitivity allows us to be able to not only look for things that we couldn’t before, but to control for them.”

The new platforms are compatible with ABI’s reagents and workflow technologies including MRMPiolot and MultiQuant software for targeted quantitative proteomics and mTRAQ reagents.

The systems sell for between $450,000 and $490,000. ABI has orders for them already, Lauman said, and the company is shipping the instruments now.

‘In Line with the Herd’

The launch of the instruments comes after months of speculation about ABI’s mass-spec business, and promises from company officials that major new instruments would be hitting the market by the end of the year. While ABI is still regarded as the industry leader, there was at least the perception that it, and by extension MDS, was becoming complacent as a technology innovator.

The last major mass spec introduction from ABI was in 2005 when it launched the API 5000 for small-molecule analysis in January, followed up four months later with the launch of the 4800 MALDI TOF/TOF for protein biomarker study.

Since then ABI has put out new systems, but rather than being revolutionary the new introductions were seen as incremental improvements on existing platforms.

In the meantime, competitors such as Thermo Fisher Scientific and Waters took advantage of ABI’s technology lull by launching new Orbitrap and Synapt instruments, respectively, which they pushed as transformative technology. Simultaneously, Agilent Technologies, once seen as a marginal player in the mass-spec space, broadened its presence in the market.

Peter McDonald, an analyst at research and investment firm Wall Street Access, called last week’s launches an important step for ABI to beat back the competition. “It’s definitely necessary to keep them in line with the herd, so to speak, and maintain their market leadership position,” he said. “I don’t know that it’s a dramatic reshaping of the landscape but it definitely adds another wrinkle and it may force people to … delay purchases a little bit longer if they need to take a look at the new systems.

“Overall, it’s probably good for the space as it continues to drive uptake and expand the whole market potential for this,” he said.

Lauman acknowledged that the development cycle for the Triple Quad 5500 and QTrap 5500 took longer than ABI had anticipated but because of the innovations incorporated into the design of the instruments “allows us to create derivative platforms very rapidly.”

Boorn said that the two launches represent only the third time in the 25 years that MDS has been in the LC-MS business that it has created a new platform from the ground up.

“Our research and engineering team examined every component in the system and basically changed them all, and then in very tight iterative loops with our customers around the world, asked them if this was truly going to address their questions,” he said.

Some of the questions and requests coming from customers “were very difficult to solve,” he added, including the need for smaller instruments. The new systems have a 44-percent smaller footprint than previous systems.

In addition, increasing the speed of the systems was a very “challenging part of the development task and required the complete redesign of the electronics and the invention of new scanning modes and designs of the ion optics [to] address those really, really, really fast scanning requirements,” Boorn said.

For ABI, the launches come at an especially challenging time for its mass-spec business. While its competitors have been citing healthy growth in their mass-spec sales in recent quarters — albeit without giving specific numbers — ABI’s year-over-year mass-spec sales have been trending down. For six straight quarters, its mass-spec sales have steadily declined year-over-year from 14 percent in the three months ended Dec. 31, 2006, to less than 1 percent for the quarter ended March 31, 2008.

For the three months ended June 30, the most recent quarter for which figures are available, sales of ABI’s mass specs rose 4 percent year-over-year. The company will release its fiscal 2009 second-quarter results on Oct. 22.

Both Tony White, the former CEO of Applera, ABI’s parent company before it split ABI and Celera into two independent firms, and Mark Stevenson, president and COO of ABI, have acknowledged that the delay in new instrument platforms has put a dent in the company’s mass-spec sales [See PM 01/31/08 and 07/31/08].

When ABI and Invitrogen announced its $6.7 billion merger during the summer, speculation immediately arose that ABI’s mass spec business could be sold because it didn’t fit into the combined company’s business model [See PM 06/19/08]. While ABI and Invitrogen officials have steadfastly said that they have every intention of keeping the mass spec business, MDS’ CEO Stephen DeFalco, sounded a more equivocal note at a recent analyst conference, saying the company was evaluating its joint-venture agreement with ABI and had not ruled out buying the mass spec business from its partner [See PM 09/25/08].

ABI and Invitrogen, however, recently announced that mass spectrometry will make up one of four divisions in the newly combined company. Last week Stevenson called this “a very exciting time for the mass spectrometry market,” as uses for the instruments continue to evolve for a growing number of applications. The launch of the systems “demonstrates our continued commitment to this important market,” he said.

As the ABI/Invitrogen merger closes in on an anticipated November closing, the mass spec launch as well as the introduction of its SOLiD 3.0 next-generation sequencing platform indicates that ABI remains aggressive about technology development, said McDonald, the Wall Street analyst.

“I think it’s a good indication that the merger itself is not distracting them from their new product momentum, which is a good sign for once the deal closes that each of these business can be integrated pretty well,” he said.

相关链接:

突破与超越——AB公司推出QTrap 5500和三重四极5500型质谱仪

-

市场商机

-

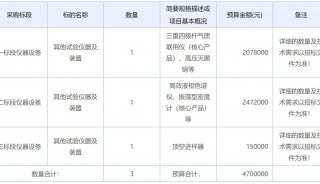

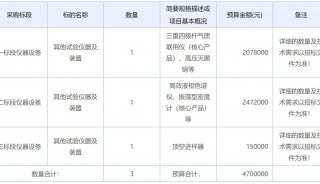

招标采购

-

招标采购

-

招标采购

-

招标采购

-

招标采购

-

招标采购

-

招标采购

-

精英视角

-

招标采购

-

招标采购

-

招标采购

-

招标采购

-

招标采购

-

招标采购

-

招标采购

-

招标采购

-

招标采购

-

招标采购

-

招标采购

-

企业风采

-

企业风采

-

招标采购

-

市场商机

-

招标采购

-

市场商机

-

招标采购

-

企业风采

-

企业风采

-

市场商机

-

项目成果

-

市场商机

-

市场商机

-

焦点事件

-

市场商机

-

招标采购

-

招标采购

-

招标采购

-

招标采购

-

招标采购

-

招标采购

-

招标采购

-

招标采购

-

市场商机

-

招标采购

-

招标采购

-

企业风采

-

焦点事件

-

焦点事件

-

企业风采

-

企业风采

-

产品技术

-

标准

-

焦点事件

-

招标采购

-

标准

-

企业风采

-

项目成果

-

技术原理

-

焦点事件

-

焦点事件

-

招标采购

-

焦点事件

-

焦点事件

-

产品技术

-

企业风采

-

企业风采

-

焦点事件

-

招标采购

-

招标采购

-

招标采购

-

焦点事件

-

企业风采

-

招标采购

-

企业风采

-

招标采购

-

招标采购

-

招标采购

-

招标采购

-

焦点事件

-

企业风采

-

产品技术

-

产品技术

-

产品技术

-

产品技术

-

焦点事件

-

焦点事件

-

焦点事件

-

产品技术

-

焦点事件

-

政策法规

-

产品技术

-

产品技术

-

产品技术

-

产品技术

-

产品技术